Economic History of Britain is a captivating journey of change, growth, and resilience. From being a generally agrarian society to becoming the cradle of the Industrial Revolution and a dominant worldwide financial center, the advancement of Britain’s economy is a story of innovation, extension, and adaptation. Understanding this history not only sheds light on how Britain became a leading economic power but also provides insights into the broader powers that have formed worldwide financial improvement. This article explores the key stages of Britain’s financial development, following its economic journey from pre-industrial times to the modern-day service-driven economy.

The Pre-Industrial Revolution Era (Before 1760)

Before the Industrial Revolution, Britain was fundamentally an agrarian society with an economy intensely dependent on agriculture. Land proprietorship and cultivating were the spine of economic activity, with a majority of the populace living in rural regions. However, trade was starting to play a progressively noteworthy role, especially as Britain’s maritime prowess grew. Mercantilism, the dominant economic theory of the time, emphasized the accumulation of wealth through trade surpluses and the foundation of colonies.

The Colonial extension provided Britain with access to raw materials and new markets, laying the establishment for future financial development. The transatlantic trade, especially in products like sugar, tobacco, and cotton, significantly boosted Britain’s wealth. This period also saw the rise of early financial institutions, such as banks and joint-stock companies, which would afterward play a critical part in funding industrial ventures.

The Industrial Revolution (1760-1830)

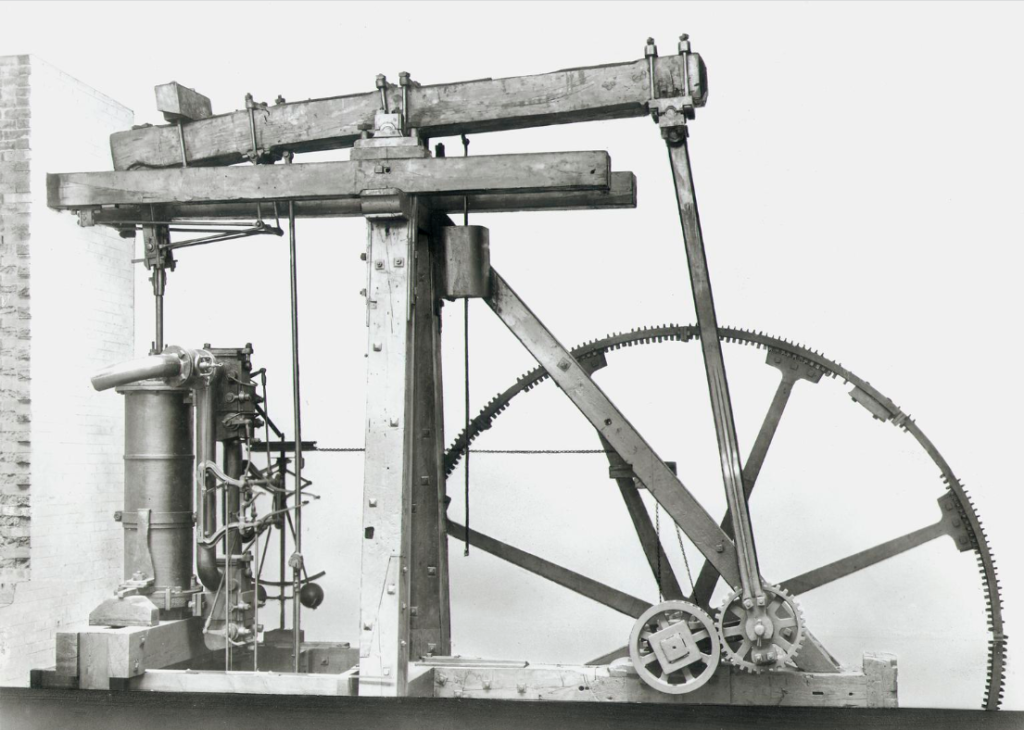

The Industrial Revolution marked a turning point in Economic History of Britain. It was during this time that Britain transitioned from a transcendent agrarian economy to an industrial one. Key innovative developments, such as James Watt’s steam engine and the mechanization of textile production, revolutionized manufacturing processes. Industries like textiles, coal mining, and iron production extended quickly, driving to phenomenal levels of productivity and economic development.

One major effect of the Industrial Revolution was the rise of urbanization. As industrial facilities sprang up in cities, people flocked from rustic zones in search of work, driving to the development of industrial towns and cities. The concentration of labor in these urban centers further fueled financial extension, although it also brought challenges such as poor living conditions and social distress.

The Rise of Capitalism and Global Trade (1830-1900)

By the 19th century, Britain had emerged as the world’s leading economic control. The growth of capitalism, characterized by private possession and the pursuit of benefit, was central to this dominance. Financial institutions flourished, with the extension of banking, stock exchanges, and insurance companies playing a vital part in financing industrial enterprises and worldwide trade.

Britain’s vast realm was integral to its economic success. The colonies not only gave raw materials but also served as captive markets for British manufactured products. The Victorian Time, often depicted as a period of economic boom and success, saw Britain dominate global trade, with its products reaching all corners of the world. The improvement of infrastructure, such as railways and telegraphs, further enhanced Britain’s commercial reach and proficiency.

The Role of the British Empire in Economic Growth

The British Realm was not just a political entity; it was an economic engine that fueled Britain’s development for centuries. The colonies were exploited for their assets, from cotton in India to sugar in the Caribbean, which were then handled and sold by British industries. The East India Company, a powerful trading organization, epitomized this model, amassing riches through trade monopolies and regional control.

The triangular trade, including the trade of goods between Europe, Africa, and the Americas, also enhanced Britain. While this trade contributed to the riches of the British elite, it was built on the abuse of enslaved individuals, a dark chapter in Britain’s financial history that fueled its early prosperity.

The Birth of Modern Financial Institutions

As Britain’s economy developed, so did the requirement for modern monetary frameworks. The foundation of the Bank of England in 1694 marked the start of advanced central banking. The institution played an essential part in overseeing public debt, issuing money, and stabilizing the monetary framework. London’s stock exchange, established in the 18th century, became the center for exchanging shares and bonds, encouraging capital collection for businesses.

The growth of insurance companies and monetary instruments like government bonds and commercial paper helped spread monetary risk, empowering further investment and financial extension. By the 19th century, Britain’s monetary foundation was strong and innovative, able to support both domestic development and worldwide exchange.

The Economic Impact of the World Wars (1914-1945)

The first half of the 20th century was a time of financial turmoil for Britain, initially because of the World Wars. World War I put a colossal strain on the economy, driving high levels of loans and expansion. The interwar period saw Britain struggle with moderate recuperation, unemployment, and the effect of the Great Misery.

World War II, while inevitably driving to triumph, left Britain financially debilitated. The war’s exertion drained capital, devastated the framework, and left the nation intensely indebted. The post-war years required broad modifying, both in terms of physical foundation and financial approach. The introduction of the welfare state, including the National Health Service (NHS), highlighted a critical move towards government intercession within the economy.

The Post-War Economic Boom (1945-1973)

In spite of the challenges of reconstruction, the post-war period was marked by quick economic growth. Known as the “Golden Age of Capitalism,” this time saw rising living benchmarks, full employment, and the development of manufacturing industries. Britain also played a key part in building up global financial institutions like the International Monetary Fund (IMF) and the World Bank, which contributed to stabilizing worldwide exchange and funds.

The development of the welfare state, including investments in healthcare, education, and social security, fostered a more impartial distribution of wealth. However, by the late 1960s, financial challenges such as rising expansion and mechanical stagnation started to emerge, signaling the conclusion of the post-war boom.

The Decline of British Manufacturing and Rise of Financial Services (1970s-1990s)

The 1970s and 1980s checked a period of critical financial rebuilding in Britain. Deindustrialization became a key drift, with conventional manufacturing segments declining due to competition from overseas, inventive movements, and shifts in customer demand. The closure of industrial facilities led to mass unemployment in mechanical regions, activating social distress.

During this period, monetary services started to rise in prominence, especially in London, which emerged as a worldwide financial center. The approaches of Prime Minister Margaret Thatcher, including privatization, deregulation, and a move towards free-market capitalism, quickened this transition. The “Big Bang” financial deregulation of 1986 changed the City of London, making it a center for global fund and investment banking.

Britain in the 21st Century: A Service-Oriented Economy

Within the 21st century, Britain’s economy is overwhelmingly service-oriented, with finance, innovation, and creative industries leading development. London remains a leading monetary capital, attracting worldwide talent and investment. However, this move towards services has left certain locales of the UK struggling with financial disparity, especially in former industrial regions.

Globalization has had a blended effect on Britain. While it opened new markets and opportunities for British businesses, it also exposed them to more noteworthy competition and financial instability. The 2008 monetary crisis was a stark update of the risks inherent in an economy intensely dependent on the monetary segment.

Brexit and its Economic Implications

Brexit has been one of the foremost critical events in recent Economic History of Britain. The choice to leave the European Union was driven by a combination of political, social, and financial components. Supporters contended that Brexit would permit Britain to recapture control over its exchange approaches, while critics cautioned of financial disturbance.

The short-term effects of Brexit included a decrease in the esteem of the pound, instability in monetary markets, and challenges for businesses dependent on European exchange. In the long term, the impacts of Brexit are still unfurling, with debates proceeding over its effect on segments like manufacturing, agribusiness, and services. While there are potential opportunities for new exchange agreements, the financial landscape remains uncertain.

Key Figures in Britain’s Economic History

Britain’s economic improvement has been formed by powerful figures whose thoughts and approaches have left an enduring legacy. Adam Smith, frequently considered as the father of modern economics, laid the establishment for capitalist theory with his seminal work The Wealth of Nations. His thoughts on free markets and competition proceed to impact financial thought today.

John Maynard Keynes was another significant figure, whose speculations on government intercession in the economy during times of crisis revolutionized economic policy, especially during and after the Great Depression. Keynes’ thoughts underpinned much of Britain’s post-war financial technique.

Margaret Thatcher, frequently depicted as a transformative figure in British financial history, championed free-market policies, privatization, and deregulation. Her authority reshaped Britain’s economy, leading to both significant development in the monetary segment and deep social partitions.

Lessons from Britain’s Economic Journey

Britain’s financial history offers a few vital lessons for understanding financial growth and resilience. Innovation, whether in technology or funds, has been a consistent driver of financial development. Equally important has been Britain’s capacity to adapt to changing global conditions, from the Industrial Transformation to the rise of the digital economy.

Nevertheless, the path has been full of challenges. The decrease in manufacturing, rising imbalance, and the financial instability surrounding Brexit highlight the complex interaction between policy, global markets, and residential conditions. Britain’s experience underscores the significance of balancing financial development with social stability and impartial distribution of wealth.

Conclusion

The economic history of Britain is a story of change, strength, and global impact. From the early days of agrarian trade to becoming a global monetary powerhouse, Britain’s financial development has been formed by technological development, strategic policy decisions, and its special position on the world stage. Understanding this history isn’t only essential for grasping the establishment of modern economic thought but also for appreciating the challenges and opportunities confronting Britain today.

FAQs

1. What was the main driver of Britain’s economic growth?

The Industrial Revolution was the primary driver, marked by technological innovations, industrial expansion, and the growth of trade.

2. How did the British Empire contribute to Britain’s wealth?

The empire provided raw materials, markets for goods, and financial resources, which fueled Britain’s industrial and commercial growth.

3. Why did Britain deindustrialize in the late 20th century?

Deindustrialization resulted from global competition, technological changes, and a shift towards a service-based economy.

4. How did the Industrial Revolution change Britain’s economy?

It transformed Britain from an agrarian society into an industrial powerhouse, leading to urbanization and the growth of factories.

5. What are the economic impacts of Brexit on Britain?

Brexit has led to economic uncertainty, challenges for trade, and potential long-term shifts in sectors like finance, agriculture, and manufacturing.